Getting My Medicare Graham To Work

Getting My Medicare Graham To Work

Blog Article

The smart Trick of Medicare Graham That Nobody is Talking About

Table of ContentsMedicare Graham Fundamentals ExplainedThe Only Guide for Medicare GrahamNot known Facts About Medicare GrahamA Biased View of Medicare GrahamMedicare Graham Can Be Fun For Anyone

An individual that joins any one of these plans can approve power of attorney to a trusted individual or caretaker in instance they come to be not able to manage their affairs. This suggests that the individual with power of attorney can administer the policy in support of the strategy holder and view their clinical info.

Some Known Incorrect Statements About Medicare Graham

Make sure that you comprehend the fringe benefits and any benefits (or flexibilities) that you may lose. You may want to take into consideration: If you can transform your current doctors If your medications are covered under the plan's medication checklist formulary (if prescription medicine insurance coverage is given) The monthly premium The cost of protection.

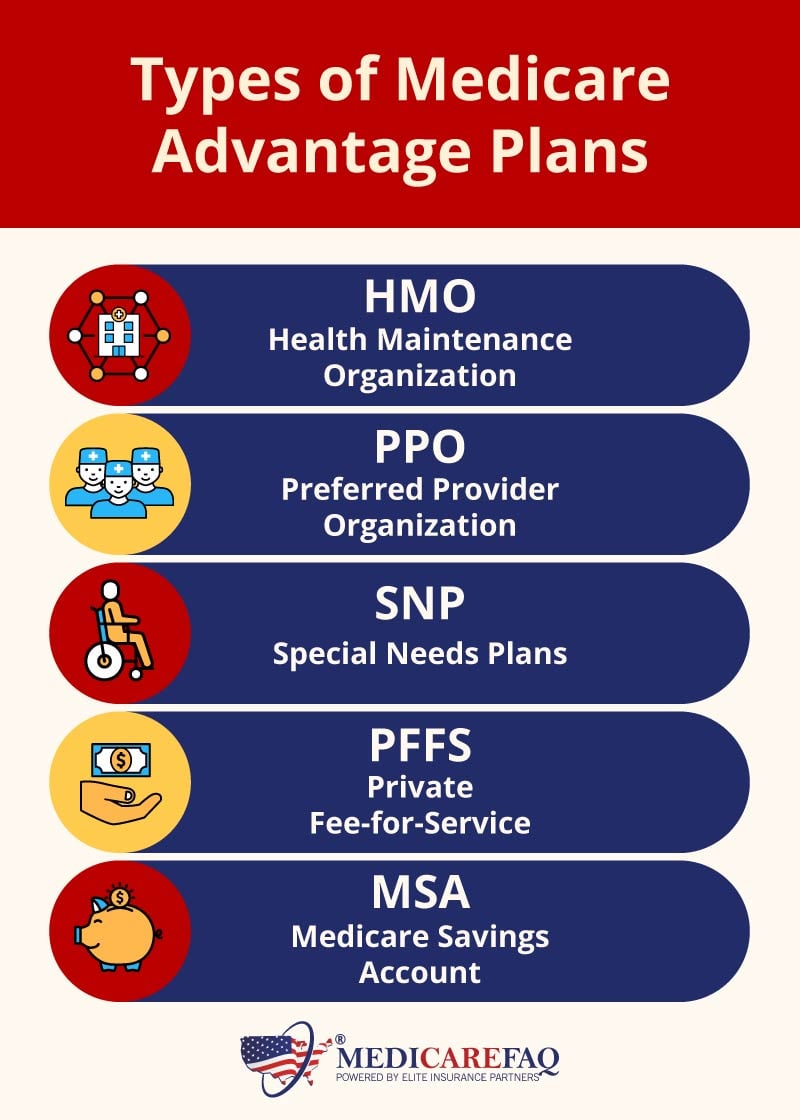

What added solutions are supplied (i.e. preventative treatment, vision, oral, gym membership) Any treatments you need that aren't covered by the plan If you intend to register in a Medicare Advantage plan, you must: Be eligible for Medicare Be enrolled in both Medicare Component A and Medicare Component B (you can examine this by describing your red, white, and blue Medicare card) Live within the strategy's service area (which is based upon the area you live innot your state of home) Not have end-stage kidney illness (ESRD) There are a couple of times throughout the year that you may be eligible to alter your Medicare Advantage (MA) strategy: The takes place annually from October 15-December 7.

Your new protection will begin the initial of the month after you make the button. If you need to transform your MA strategy outside of the typical registration periods described over, you may be qualified for an Unique Registration Period (SEP) for these certifying events: Relocating outdoors your plan's coverage area New Medicare or Component D strategies are offered due to a transfer to a brand-new irreversible place Recently released from prison Your strategy is not renewing its agreement with the Centers for Medicare & Medicaid Services (CMS) or will certainly quit supplying benefits in your location at the end of the year CMS may additionally establish SEPs for sure "remarkable problems" such as: If you make an MA enrollment demand into or out of an employer-sponsored MA strategy If you want to disenroll from an MA strategy in order to register in the Program of All-inclusive Treatment for the Elderly (PACE).

Some Known Questions About Medicare Graham.

person go to this web-site and have come to be "legally present" as a "certified non-citizen" without a waiting duration in the USA To verify if you're qualified for a SEP, Medicare.contact us. Medicare West Palm Beach.

Third, take into consideration any kind of clinical solutions you may require, such as validating your existing physicians and experts accept Medicare or finding coverage while away from home. Check out regarding the insurance coverage business you're thinking about.

The Ultimate Guide To Medicare Graham

To pick the best insurance coverage for you, it's essential to recognize the fundamentals concerning Medicare. We've gathered everything you require to recognize regarding Medicare, so you can select the strategy that best fits your demands.

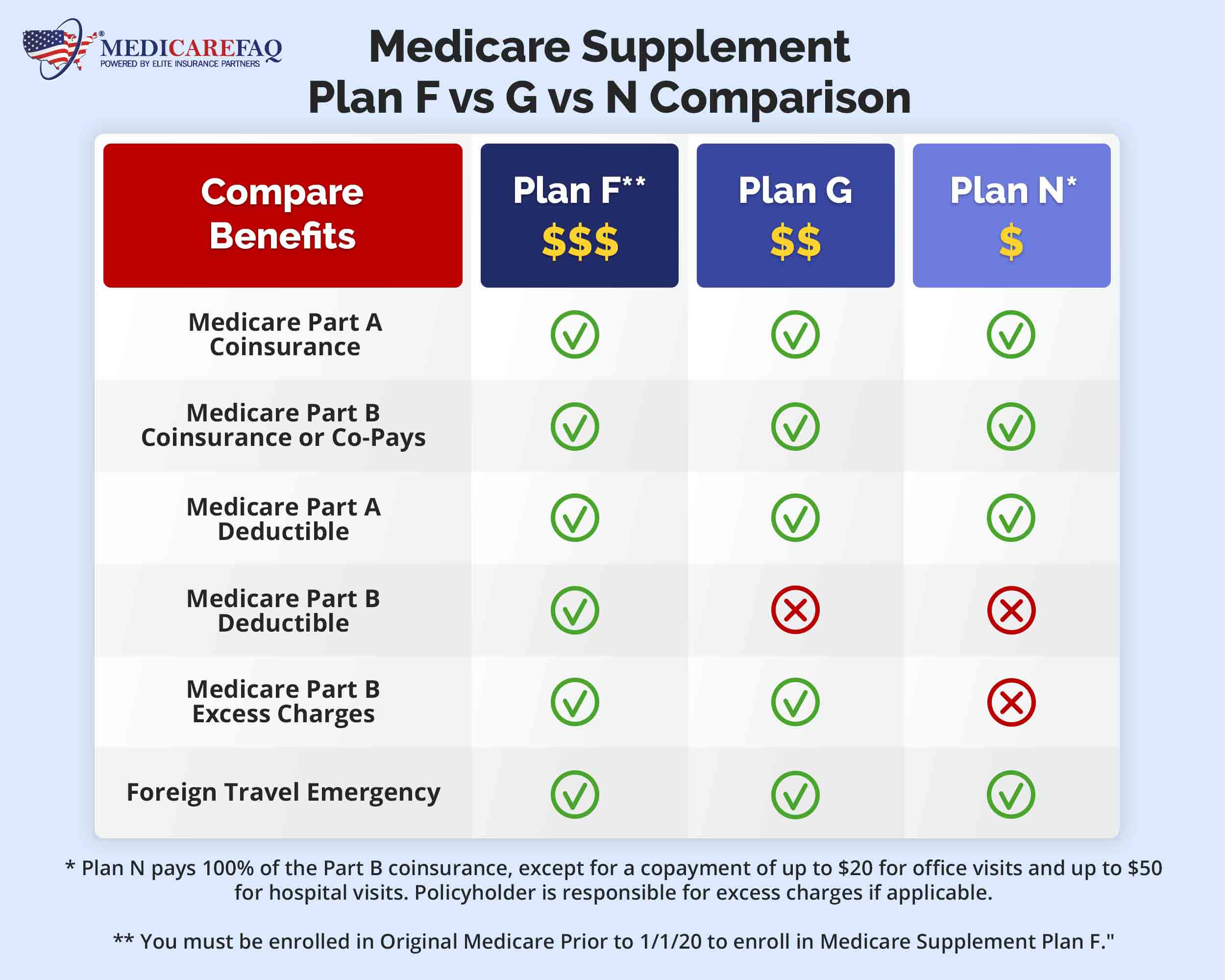

Medicare supplement strategies are simplified right into courses AN. This classification makes it easier to compare a number of supplemental Medicare plan kinds and pick one that best fits your requirements. While the standard advantages of each kind of Medicare supplement insurance policy plan are uniform by service provider, costs can vary between insurance companies.: In addition to your Medicare supplement plan, you can choose to acquire additional insurance coverage, such as a prescription medicine plan (Part D) and dental and vision coverage, to assist satisfy your details needs.

You can find an equilibrium in between the plan's price and its insurance coverage. High-deductible strategies offer low costs, yet you may have to pay even more out of pocket.

Some Known Facts About Medicare Graham.

Some plans cover foreign travel emergencies, while others exclude them. Note the medical services you most value or may require and see to it the plan you choose addresses those demands. Private insurance coverage business use Medicare supplement strategies, and it's suggested to read the small print and contrast the worth various insurers provide.

It's always a great idea to talk to reps of the insurance policy service providers you're thinking about. And, when evaluating particular Medicare supplement insurance coverage companies, research study their durability, checked out customer reviews, and get a feeling of the brand name's credibility in the insurance area. Whether you're switching Medicare supplement plans or purchasing for the very first time, there are a couple of things to think about *.

Report this page